What is comprehensive car insurance? What does it cover? And what does it not cover?

Comprehensive insurance is an optional car insurance coverage. It pays for damage to your car from causes other than a collision. So It covers theft, vandalism, fire, accidents with animals, natural disasters, and other acts of nature. It also may cover glass and windshield damage. If your car is stolen or destroyed, it helps pay to replace it. If you finance a vehicle purchase, you may be required to have comprehensive coverage. Also, see property damage car insurance and liability only car insurance.

What is comprehensive car insurance?

It is a type of auto insurance coverage. It helps protect your vehicle from damage or loss due to non-collision events. Such as theft, fire, vandalism, natural disasters, and falling objects.

Comprehensive coverage is often optional. But we recommend it for drivers who want to have extra protection beyond the minimum required by law. You can purchase it as a standalone policy or as part of a larger insurance package.

It provides peace of mind. But it’s important to note that it doesn’t cover everything. For example, it typically won’t cover damage caused by a collision or any injuries sustained in an accident. It usually comes with a deductible, that is the amount you’ll have to pay out of pocket before your coverage kicks in.

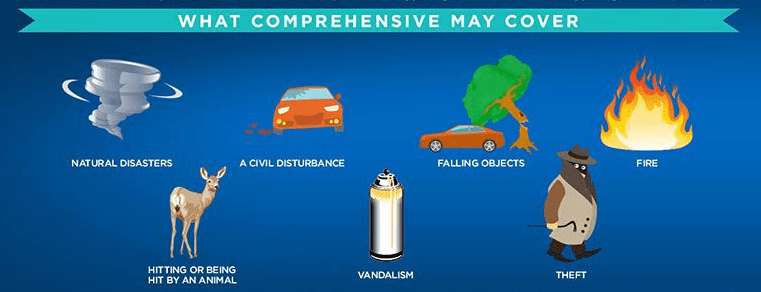

What does comprehensive car insurance cover?

Comprehensive insurance, also known as “comp” coverage. So it typically covers a wide range of non-collision incidents that damage or total your vehicle. Some of the events that it covers include:

- Theft: If your vehicle is stolen, it helps you to cover the cost of replacing it.

- Fire and explosions: It can help cover the cost of repairing or replacing your vehicle if it is damaged by fire or explosions.

- Natural disasters: If your vehicle is damaged or destroyed by a natural disaster, such as a tornado, hurricane, or flood, it helps you to cover the cost of repairs or replacement.

- Vandalism: If your vehicle is intentionally damaged by someone, such as through keying or graffiti, it helps you to cover the cost of repairs.

- Falling objects: This helps to cover the cost of repairing or replacing your vehicle if falling objects, such as tree branches or debris damage it.

It’s important to note that comprehensive insurance coverage may vary by policy and provider. So it’s important to carefully review your policy details to understand what is and isn’t covered. Additionally, it typically comes with a deductible. Which is the amount you’ll have to pay out of pocket before your coverage kicks in.

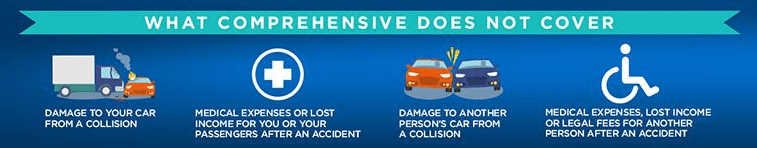

What does comprehensive car insurance not cover?

Comprehensive insurance is designed to provide coverage for non-collision events that can damage or total your vehicle. But it does not cover everything. Some examples of events that typically do not cover include:

- Collision damage: If you are involved in a collision with another vehicle or object, it will not cover the cost of repairing or replacing your vehicle. Collision coverage is a separate type of insurance that helps cover these types of incidents.

- Personal injuries: Comprehensive insurance does not cover any injuries sustained by you or your passengers in an accident. Personal injury protection or medical payment coverage can help cover these types of expenses.

- Mechanical breakdowns: If your vehicle experiences a mechanical breakdown, it will not cover the cost of repairs. An extended warranty or mechanical breakdown insurance can provide coverage for these types of issues.

- Driving under the influence: If you are driving under the influence of drugs or alcohol at the time of an accident, it may not provide coverage.

- Intentional damage: If you intentionally damage your vehicle or someone else’s vehicle, it will not cover the cost of repairs or replacement.

It’s important to carefully review your policy to understand what is and isn’t covered, and to speak with your car insurance provider if you have any questions or concerns(1).

Pros And Cons; Is comprehensive car insurance Worth its cost?

Pros

- Avoid paying out of pocket for repairs or replacements of your vehicle if it is damaged by a covered peril.

- Reduce the risk of being sued by another party if your vehicle is involved in an accident that damages their property or injures them.

- Enjoy additional features and services that may be included in your policy, such as roadside assistance, rental car reimbursement, or glass coverage.

Cons

- Does not cover damages to your vehicle caused by collisions with other vehicles or objects, which requires a separate collision coverage.

- Does not cover damages to your vehicle caused by normal wear and tear, mechanical breakdown, or depreciation.

- May have a deductible, which is the amount you have to pay before the insurance company pays for the claim.

- May have a limit, which is the maximum amount the company will pay for the claim.

- It increases your premium, which is the amount you have to pay for the policy.

Leave a Reply