Hugo Car Insurance Company is a new and revolutionary company that uses cutting-edge technology to make financial stability possible for every American. It was founded in 2018 by Dan Peate and Jonny Simkin. Hugo Insurance offers pay-as-you-go or pay-per-mile liability insurance that lets you buy days, weeks, or months of coverage according to your needs and budget. Based on Hugo’s car insurance reviews, they offer flexible and affordable coverage for drivers who don’t drive much. They also have features like auto-reload and coverage extension that keep you covered and give you extra time to pay.

Hugo’s rates are also affected by your driving history. If you have a clean driving record, you can expect to pay an average of $220 monthly for full coverage and $165 for liability-only coverage. The company is based in Santa Monica, California.

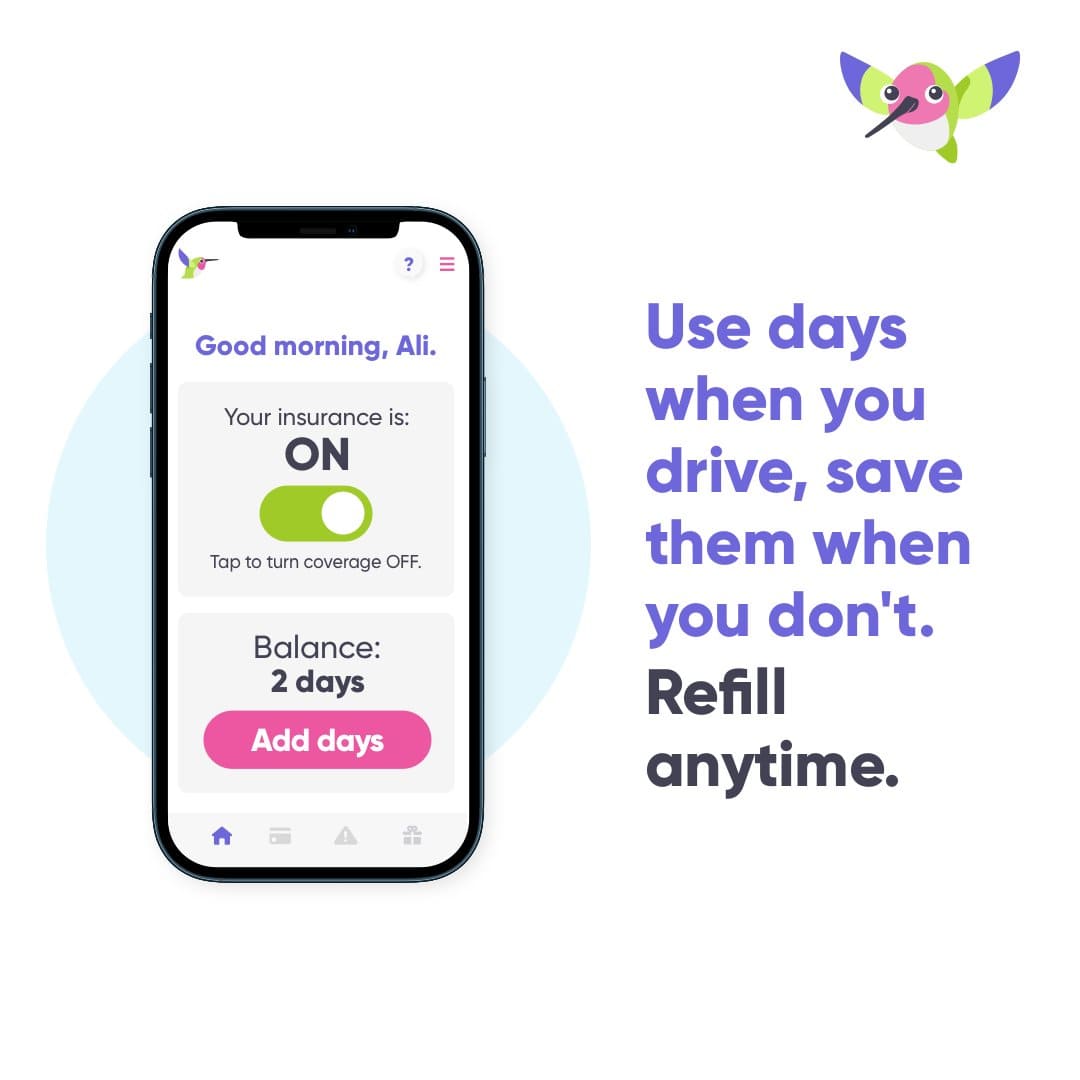

Hugo car insurance works by letting you pay only for the days you are driving. The policy can be turned on and off via text message, and Hugo will only charge you for the used days out of a prepaid bank. You can also buy coverage for three days up to six months, depending on your plan. There is no up-front fee and no down payment. You can get proof in under 6 minutes. It works for drivers who want to save money and have flexibility. How Car Insurance Companies Work.

Hugo Insurance reviews in 1 minute

Hugo car insurance reviews are mixed from different sources. Trustpilot ratings are generally positive, with an average rating of 4.9 out of 5 stars. Many Hugo insurance reviews praise its fast, user-friendly, convenient, and affordable pay-as-you-go car insurance. But other reviews have lower ratings. For example, Consumers Advocate rates Hugo Insurance at 3.8 out of 5 stars. For example, some customers have also complained about poor communication, hidden fees, and coverage issues with Hugo.

Hugo car insurance quotes and average rates

Hugo car insurance average rates depend on various factors, such as your location, driving history, and plan choice. According to some sources, the average monthly cost for Hugo is $215 for full coverage. Compared to the national average for 18-year-olds — $230 per month for liability and $676 for full coverage — Hugo makes the biggest difference in car insurance for teen drivers who need full coverage. At $496 per month, full coverage from Hugo is significantly cheaper than average.

To get a quote from Hugo Insurance, you can follow these steps:

- Go to Hugo’s website

- Fill out the quote form with your personal and vehicle information, such as your name, date of birth, driver’s license number, ZIP code, and VIN.

- Choose the plan that suits your needs: Flex, Unlimited Basic, or Unlimited Full.

- Sign your policy and start driving insured in minutes.

- You can also get a quote from Hugo’s app, which is available for iOS and Android devices

The average monthly cost for Hugo is $165 for liability-only coverage. Hugo’s liability-only rates are higher than average (the national average for 65-year-olds is $97 per month for liability coverage). However, Hugo offers flexible payments and no upfront fees, which may suit your budget and needs better. The average rate for Hugo in Minnesota is $1,342 per year. Hugo car insurance rates by state may vary, so you can check the table below for more details.

| State | Average Liability Rate |

| California | $1,254 |

| Colorado | $1,368 |

| Florida | $1,520 |

| Georgia | $1,296 |

| Illinois | $1,176 |

| Michigan | $2,050 |

| Nevada | $1,440 |

| New Jersey | $1,728 |

| New York | $2,205 |

| Ohio | $995 |

| Pennsylvania | $1,080 |

| Texas | $1,560 |

| Virginia | $970 |

Discounts

Hugo car insurance does not offer discounts in the traditional sense. However, they have a unique feature for specific plans that allows you to turn off your coverage for the days you don’t drive. This means you only pay for the days you drive. This can be a significant saving for drivers who drive infrequently. With Hugo’s flex plan, you can turn coverage on and off at any time, which means you’re only paying for the days you need coverage. Hugo also has no upfront fees and coverage extension options that can help you save money.

Hugo car insurance pros and cons

Pros of Hugo car insurance: PROS

- Low monthly base rate and per-mile rate

- Based on Hugo car insurance reviews, easy to use app and an online dashboard

- Good customer service and claims handling

- Hugo’s plans only allow you to pay car insurance when needed. You can buy coverage for days, weeks, or months and turn it on or off as needed.

- They have cash rewards that are available for using their service.

- Hugo has a low monthly base rate and per-mile rate, and no upfront fees or extra costs. You only pay for the coverage you use.

- It offers flexible, on-demand coverage for drivers who work from home or drive infrequently

- Has no up-front fees and a $0 down payment for all plans.

- Allows drivers to make micropayments for as few as three days of coverage and up to six months at a time, depending on the plan.

- Has an auto-reload feature that automatically refills your days of coverage at no extra cost.

- Has a coverage extension feature that gives you a few extra days to pay if you run out of money.

- Lets you control your policy from your phone or online, make changes, add or remove drivers, and get instant proof of insurance.

- It takes just a few minutes to get coverage online or through their app

Cons of Hugo car insurance: CONS

- It is only available in 13 states: Alabama, Arizona, California, Florida, Georgia, Illinois, Indiana, Mississippi, Ohio, Pennsylvania, South Carolina, Tennessee, and Texas.

- Limited coverage options and discounts

- Not suitable for frequent or long-distance drivers

- Requires a device to track mileage

- The app is sometimes glitchy or slow.

- Customer service is not very responsive or helpful

- Some rental companies or dealerships do not accept the coverage. See Cheapest Rental Car Insurance Companies

- It is underwritten by Aspire General Insurance Company (AGIC), which has a B+ rating from A.M. Best, indicating a fair financial strength

Hugo car insurance reviews

Positive reviews

- Great insurance! Instant proof too! Start off price was amazing and even got me covered for longer than expected. Why did I not find this company sooner? Game changer! Highly recommend it for all teens!

- The best insurance company out right now is fast convenient and very affordable. You pay at your own pace and can cancel anytime. Love it. Thank you !!

- Quick & EASY & when I was in a bind and Progressive wanted me to pay over $800 for a down payment! I’ve been a licensed insurance agent for years & have not yet seen a “weekly” pay option! Love it!

- It was very easy getting in threw Hugo just enter your information and pay for what you need no down payment no extra BS thank you, Hugo.

- Love these guys They are so fast to set up and have multiple pay categories to fit your everyday life. Thank you so much I think it took me 8 minutes and I was covered.

- I downloaded this app because my insurance had run out and I needed insurance to go to work so I decided to try Hugo out and so far it’s great. U can pay whatever and you can also cut it off when u need to. Great app.

- It’s cheap, affordable and legit. Pay as you go or however, it fits your needs. I would recommend Hugo Insurance to anyone! Thank you, Hugo!!

- It was a fast and online easy application with no one to try to update me .. the whole experience was awesome!!!

Negative Reviews

- When I tried to get in contact with customer service there was no phone number and in the email I sent no one contacted me back.

- This app is very misleading. It says you’re paying for 30 days but got a notice a week ahead of the 30 days saying I was not covered. Also, I just tried to pay for another 30 days and I can’t tell if it works or not. I think I’ll be looking for another company for next month.

- I think the concept is great but what they don’t tell you, you are forced to switch the insurance back to one in 3 days or your rate could change. When I turn it on they take my money right away when I turn it off I have to wait a whole day.

- Bad insurance high price.

- Heard about this company through a friend who tried it and it would freeze tried later same thing so I emailed support no responses. The next day thought I’d give it another try thing tried a different address and thought it was my address because that’s where it would freeze but nope! So I just gave up, there is no number to call!

- Do not respond quickly and do not see my other car in my proof insurance that supposed 2 cars in insurance.

- Ads say $40/mo but it turns out to be $45 every 3 days $485/mo…talk about overkill on pricing, false advertising, and way over budget for state min, not happy and not going to keep them. Will be looking elsewhere after this absolutely false advertising.

Positive reviews 2

- Hugo is great for someone who needs immediate insurance. Quick, fast, and effective online services.

- This is awesome!! Especially since I just moved to town and do not know what the insurance laws are here. This helps a lot until I can do better research.

- Unlike most places, I literally got my insurance in 5 minutes and only spent $27 to start it for 3 days.

- Hugo insurance is there when I need to go to the doctor and store but I have been trying to pay my insurance for 2wwek now one call me 7th New number old number 678 619 7954 I need my info now.

- Easier than could imagine! And cheaper than the rest! I am totally satisfied. It’s almost too good to be true.

- Never thought getting insurance would be so easy. Love it.

- It’s very helpful for people who are struggling with money or gives them a chance to pay as they go.

- Easy to work with no gimmicks!! I NEEDED INSURANCE and they provided guidance and were easy to understand and easy to pay..I recommend it 100%.

- Writing a forced review has been the worst part of my experience.

- I personally chose to convert over because of the friendly payment plan, I think these insurance companies are getting over on good people and this is the epitome of it… I’d recommend this company to anyone, do yourself a favor and stop letting commercial names deflate your wallet and go with Hugo.

Hugo car insurance Negative Reviews 2

- I have been trying to get help updating information for my debit card. There’s no option to update the expiration and security code. I’ve emailed. Sent a request for help, but I can’t find a phone number. My insurance is off.

- I was facing a license suspension while working in a different state. As a result, I need to switch the state my policy is covered under, and talking to support feels impossible.

- This platform can’t secure account information. I have had the money in my access stolen from me twice. Both times at $292. Then I have repeatedly sent messages to support this without receiving even a response from them.

- I paid my insurance on July 13th and it got canceled July 16th is not the best car insurance and it’s really making things hard on me.

- I didn’t like it because they don’t have full coverage insurance in the state of Ga.

- You guys charged my account twice and u act like nothing happen I want my money back or tell me I’m good for another week.

- I’m trying to cancel now, They don’t even report to dne in a timely manner I was so embarrassed.

- 246 for liability is ridiculously outrageously high. I didn’t read properly because I was rushing, I paid less with full coverage than other companies. This is a rip-off. I wouldn’t suggest this to anyone

Coverage Plans

Hugo Insurance works by providing coverage for your car based on how much you drive. You can choose from three plans: Flex, Unlimited Basic, and Unlimited Full.

- Flex Plan: Flex is a pay-per-day plan that charges you only for the days you drive. Flex Plan is a pay-per-day liability policy that covers the other driver’s property and bodily injury expenses if you cause an accident. With this plan, you can buy 3, 7, 14, or 30 days of coverage at a time and turn it on or off whenever you need to. You can use the days when you drive and save them when you don’t. But You don’t need to pay any upfront fees or down payment. You can refill your days anytime and get instant proof of insurance.

- Unlimited Basic: Unlimited Basic is a monthly plan that offers liability coverage for unlimited driving days. This plan works best for people who drive most days and want to pay a fixed amount every month. You don’t need to pay any upfront fees or down payment. You can also turn your policy on or off via a toggle on Hugo’s website or app.

- Unlimited Full: Unlimited Full is a monthly plan that offers full coverage for unlimited driving days. This plan works best for people who want to have comprehensive and collision coverage in addition to liability coverage. You don’t need to pay any upfront fees or down payment. You can also turn your policy on or off via a toggle on Hugo’s website or app.

Hugo car insurance login

You can visit their website to learn more about their plans, features, and benefits. You can also get a quote, manage your policy, file a claim, and contact their customer service. To log in to your Hugo car insurance account, you can visit their website and click on the login button at the top right corner. You will need to enter your email and password to access your dashboard. If you don’t have an account yet, you can sign up for free by clicking on the Get Started button.

You can sign up for Hugo Insurance online or through their app in less than 2 minutes. It will need to provide some information about yourself and your car, such as your driver’s license number, address, and VIN. However, You will also need to link a payment method to your account.

Policy can controlled from your phone or online. You can make changes, add or remove drivers, and get instant proof of insurance. You can also use the app to track your driving days and payments.

Is Hugo insurance legit?

Yes, Hugo Insurance is legit and it is a licensed company that operates in California. It has strong reviews from customers and experts. It is backed by some of the largest insurance companies in the world, such as Munich Re, Sequoia Capital, Thrive Capital, and Liberty Mutual.

Contact and Phone number

To contact Hugo Insurance, you can use one of these methods:

Email: You can send an email to support@withhugo.com or to the specific department you want to reach, such as sales, marketing, or purchase.

Phone: You can call their toll-free number (844) 448-4648 from Monday to Friday, 9 am to 5 pm PT.

Chat: You can use the chat feature on their website or app to talk to a customer service representative.