How is GEICO Car Insurance Company, Quotes, Rates, Discounts? What are Professionals’ and real customers’ Geico car insurance reviews and pros and cons? What is Real customer reviews for GEICO Rental, Parked, Nonowner, and Classic Car Insurance

GEICO Group is represented by GEICO General Ins Co (Auto), Casualty Co (Auto), and Indemnity Co (Motorcycle). Most consumers will qualify for lower rates, based on eligibility for different groups of plans. The company is the second-largest car insurance company in the United States( USA). But is it a reliable insurance provider? To answer this, we have gathered all the Geico car insurance reviews and pros and cons in one place and provided a summary for you.

GEICO offers insurance via its website and call centers. But they don’t offer you a dedicated agent, like State Farm or Farmers. They offer most of the standard options, such as liability, collision, and comprehensive coverage. On the other hand, it provides liability coverage to vehicle owners in all 50 states of the USA. Also, it makes filing a claim after an accident incredibly easy at: www.geico.com/claims.

Discounts

- California Good Drivers with a clean driving record for 5 years qualify for an additional discount of 20%-30%

- New Vehicle Discount: 15% for Comp; 5% for Coll Multi-Line Discounts:

- Up to 20% for auto customers having motorcycle and/or personal umbrella policies

- Loyalty/Persistency Discount: As customers maintain coverage with the company, they will receive persistency discounts of 5.1% – 10.1%.

- Anti-Theft Devices 5% -10%

- Drivers Training 5%

- Good Student 1%

- Group Prog Credit/Prof Degree Up to 39%

- Low Annual Mileage Driven Up to 39.5%

- Mature Drivers Course 5%

- Multi – Car 10% – 19%

- Multi-Policy Credit Up to 20%

- Passive Safety Features 5% (airbag)

- Persistency Credit (Retention) 5.1% to 10.1%

Quotes

The Geico can provide cheap car insurance for many drivers. For example, we reviewed estimates of full coverage for 35-year-old drivers with good credit and driving records. Based on Geico car insurance reviews, we found that their rates were about 22% lower than the national average.

Generally, Geico’s premiums will be higher if you’re a young driver or don’t have a good driving record. To see our cheapest car insurance for new drivers lis. Also if you have low credit and don’t live in California, Hawaii, Massachusetts, Michigan, or Washington, your premiums will be even higher.

Its average rate for drivers with poor credit is $3,873 per year, or $323 per month, while State Farm’s average rate is $4,300 per year, or $360 per month. The average rate for drivers with one at-fault accident is $4,50 per year, or $375 per month, while State Farm’s average rate is $3,400 per year, or $283 per month.

Sample GEICO Car insurance quotes

| Driving Profile | Geico Auto Insurance Rates |

| 24-year-old with a good driving record and good credit | $1,352 |

| 24-year-old with good driving record and good credit | $1,627 |

| 35-year-old with poor credit | $2,077 |

| 35-year-old with a recent accident | $2,427 |

GEICO Car Insurance Pros and Cons

GEICO Car Insurance Pros

- Numerous Discounts.

- Available in 50 states.

- Offers accident forgiveness.

- High policy limits.

- Strong third-party ratings.

- Cheap policies for drivers with a bad credit score.

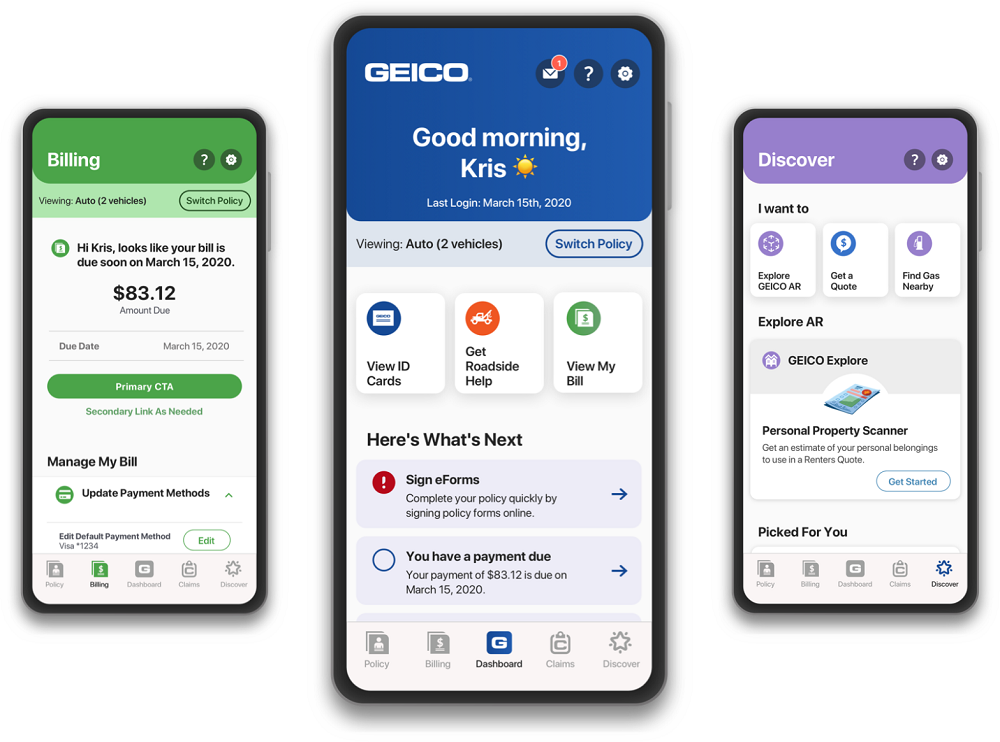

- Robust website and mobile app.

- Most recommended by real customers.

- Strong financial and industry standing.

- A++ rating from AM Best and an A+ rating from the BBB.

- Geico offers all the typical coverage options and Full breadth of products.

- Partnerships with Mexican insurance companies for Mexico coverage.

- Consistently above-average customer satisfaction rankings

- Offers many discounts including some unique options.

- You can either earn or purchase accident forgiveness.

- It has several options to submit a claim, either on the phone, through the web, or via the app.

- Competitive rates for drivers with a poor credit history.

- Usage-based insurance discount.

- Extensive range of coverage options, insurance products, and other services.

- folks who have a speeding ticket, poor credit, or were caught driving without insurance.

- Offers a usage-based program (DriveEasy) for good drivers who want to reduce their auto insurance rates based on driving habits.

- Policies designed for current and former military personnel.

- Offers mechanical breakdown insurance, which few insurers do.

GEICO Car Insurance Cons

- Usage-based apps are not available in all states.

- Doesn’t offer gap or rideshare insurance.

- Very high rates for drivers with a DUI and ticket

- Does not offer coverage for new car replacement or better car replacement

- Limited network of local agents.

- Lack of gap coverage option

- Average J.D. Power claims ratings.

- Not always the cheapest for people with poor credit or recent accidents.

- Accident forgiveness is not available in all states.

- Below average claims satisfaction in certain regions.

- Could be costly for high-risk drivers or drivers with a bad driving history.

- Geico’s rates for adding a teen driver are only so-so.

- Geico’s average discount for bundling auto and home insurance is rather low at 8%.

- Not as many optional coverages as other auto insurers

- Mechanical breakdown insurance is only available for new cars (less than 15 months old and fewer than 15,000 miles)

- Offers a main phone number with many prompts, instead of dedicated quotes and claims phone numbers.

- Inconsistent Claims Updates.

- Certain policies are underwritten by third-party partners, adding a layer of complexity.

- Average or inconsistent customer service.

Real Customers GEICO Car Insurance Reviews

Positive Reviews

- I have been a customer of Geico’s for YEARS. They have been there for me for anything I need of their services. So you cannot go wrong with Geico.

- The process of making policy and payment schedule changes is very clear and easy. Thank you for streamlining it so well.

- Spoke to three different agents and although my call went to the wrong person still found it a great experience to talk to the wrong agent. Very attentive, not the whole time, and all of them were extremely nice. I never write reviews but I had to do one for them today. Thank you so much.

- I have been insured with Geico for many years. They are a class act, who always come through with a smile and appreciation for their customers.

- I’m two years new to GEICO Insurance Company. They are always helpful over the phone. I have both car and apartment rent insurance. I bought my car two years ago (February) and it literally took less than five minutes to insure my car over the phone right from the car dealership. Their website is very user-friendly as well, which is very important to me.

- They are definitely a good Inc. car insurance to have. I really enjoy having them and the price that I get is amazing. I would recommend them to anyone. Their claims process is the easiest that I have ever gone through. You definitely get your money’s worth.

- GEICO Insurance Company is literally Amazing!! if you are not sure whether you should get with them or not GET WITH THEM!!, everything is incredibly good they’re price, their customer service, and their service.

Negative Reviews

- Never use it. Because It’s a bot, or as they say, a literal “virtual assistant.

- Customer service hung up twice on me and did not call me back. When I call back nobody knows what the last rep said to me and keeps transferring me to different departments. Took 15 days for a refund check to arrive and when I tried to bank it they had issued a cancellation. I will probably have to wait another 15 days.

- GEICO Insurance Company is absolutely the WORST company I have ever had to deal with. They are causing me so much anguish, and have hassled me to the point of intimidation! I would like to give a ZERO!

- Undeniably the worst car insurance company I’ve ever worked with. Will not pay claims and they go out of their way to make sure the claims inspection stations they use to undercut the price of fixing your car by keeping it under your deductible. Get out and fast cause they will not pay your claims. And since they have constant cute commercials with their Gecko they attract lots of new people to ripoff. However high premiums and low claims payout make them the most profitable insurance company in the world. Stay away and get out as fast as you can right now.

- Had an accident on January 4, 2022. The claim has been handled very poorly. But I can’t get anyone to call me back. I have left several messages for multiple people and no one has called me back to attempt to explain this process to me. My car is at the collision center and has not been fixed. So Geico has the worst customer service ever. People, please go elsewhere.

GEICO Car Insurance Review Part 2

Positive Reviews Part 2

- Gieco is a great company to have your car and home insurance with. The employees work to get you a great rate. Consequently, I am very thankful for their help.

- I have been with GEICO ever since it was a Government Employee Insurance Company in the ’50s, and I still love the agents that work there. They may not always be on top of everything, but they’re good.

- My experience with them has been nothing but amazing from the inception until where we are today. Superb customer service interactions. Very professional and always listen to attention for details. Very caring persona amongst them.

- I just called Geico car insurance, I am extremely pleased with the customer service. The representatives are kind, caring, and supportive. Mr. Moody explained everything, so I was able to get full coverage without Hassall asking a lot of questions about my 2017 vehicle.

- They have the best rates and totally rock when it comes to customer service.

- Their rates are very fair and honest. Therefore if you have an excellent driving record, do your wallet a favor and give them a call!

- It’s great. Easy to use app and great customer service! The rates are the cheapest rates among other major creditors. On the other hand, they have several different coverages with many options to fit customer’s needs.

- I have to say this is one of the best websites I have dealt with. Also, the customer service reps are outstanding. I want to thank you for making Geico what it is, a wonderful company.

- Adding a vehicle has been very simple and easy to do with little time needed to finish. As a result, I had the documents and just needed to fill in the blanks.

Negative Reviews Part 2

- I am unhappy with your website. For example, I have been trying to submit new information since Nov 2021.

- I HAVE TRIED 10 TIMES TO USE THE WEBSITE TO ADD A CAR AND REMOVE MY TOTALED CAR AND REVISE THE COVERAGES, SO I CALLED AN AGENT AND SHE FIXED EVERYTHING I JUST NEEDED TO SIGN THE FORMS SO I TRIED TO DO THAT 5 TIMES AND IT REJECTED IT EVERY TIME. BIG WASTE OF TIME.

- I have been insured with GEICO FOR OVER 15 YEARS. I took two vehicles off my auto insurance policy and after that, my premium increased by 50%. That’s in spite of still having 2 cars, a motorcycle, and my house insurance with them. That is to say, I am upset and understanding and I am removing all insurance from GEICO.

- My mom’s car broke down at the park. She called Geico. There were 3 of us. The guy said no problem I’ll send a tow do you need a car seat blah blah blah. The tow comes says one person. We call back and the man says “My employee would never say that.”. And as it was Friday they towed it to our house but you get one tow a year from them so come Monday we had to pay out of pocket to tow it to the mechanics. My mom went back to AAA.

- It is impossible to get to speak to a person. So there are some extenuating circumstances behind my claim. This should take 5 minutes. not days. There doesn’t seem to be a resolution to this problem.

- Gross invasion of privacy! You have no right to assume a person is driving just because they are of age and charge INSANE pricing!

GEICO classic car insurance reviews

GEICO classic car insurance is for those who own and cherish vintage or antique vehicles. Classic cars require special care and consideration. When insuring a classic car, there are a few key differences compared to regular auto insurance. The two main factors that distinguish a classic car from an ordinary one are:

- Rarity: Classic cars are unique and often have limited production runs.

- Investment: The amount of money invested in restoring or maintaining the vehicle after purchase.

Here’s what you need to know about insuring your classic car:

Selecting Classic Car Insurance:

- Classic car insurance has several advantages:

- No requirement for a vehicle appraisal.

- No depreciation in case of an accident.

- Low deductibles.

- When choosing a policy:

- Set a total value for your vehicle based on your evaluation.

- Consider creating a separate policy for your classic car to potentially lower rates.

- Ensure your car qualifies as a classic by meeting the criteria mentioned above.

GEICO’s Classic Car Insurance:

Unfortunately, GEICO’s classic car insurance isn’t directly underwritten by them, but rather by its partner, American Modern Insurance Group (AMIG). This makes finding specific GEICO classic car insurance reviews itself a bit difficult.

- GEICO provides peace of mind with policies specifically designed for collector cars.

- Enjoy full protection for your treasured antique or vintage vehicle with GEICO’s antique car insurance.

- Better Business Bureau (BBB): AMIG has an A+ rating from the BBB with mostly positive customer reviews.

- Trustpilot: Here, the rating averages out to 2.8 out of 5 stars, with mixed GEICO Classic Car Insurance reviews. Some praise the ease of claims and good customer service, while others mention issues with rates, coverage, and communication.

- National Association of Insurance Commissioners (NAIC): This government agency doesn’t have separate complaint data for classic car insurance specifically, but their overall complaint index for AMIG is within the industry average.

Pros and Cons of GEICO Classic

- The coverage is based on how much the vehicle owner and they agree the vehicle is worth. That way, if the customer is involved in an accident, their classic car can be made as good as new. In addition, they offer up to $500 coverage for spare parts.

- It is a specialized auto coverage feature. This type of policy is insurance for vintage cars, such as vintage 50s models and old military vehicles. They also guarantee that if your classic car is totaled, you get reimbursed the same value.

- According to GEICO’s website, a classic car policy can provide liability coverage, uninsured and underinsured motorist coverage, and medical coverage like personal injury protection or medical payments coverage. You can also purchase towing and roadside assistance reimbursement coverage.

Other Products

GEICO does not only offer auto insurance. They also carry other options, including homeowners, renters, and business insurance. If you plan on purchasing more than one policy, consider bundling them with your auto insurance to qualify for savings on your premiums across the board.

GEICO Car insurance for seniors

GEICO offers auto insurance discounts for seniors and drivers over 50. These discounts include defensive driving course completion, multiple car insurance policies, retired government employees, and more.

It has the cheapest car insurance for senior drivers with an average of $1,197 per year. However, it’s important to note that the cost of car insurance can vary depending on several factors such as age, driving record, location, and type of vehicle.

GEICO rental insurance reviews

GEICO offers rental reimbursement coverage as an optional coverage that helps pay your rental car costs while your car is being repaired as a result of a covered claim. You can generally keep the rental car until your damaged vehicle is back on the road or until your coverage limit runs out, whichever comes first. Click to see Best Rental Car Insurance Companies.

GEICO covers rental cars in two ways: full coverage and rental car reimbursement. Full coverage extends your policy to the rental car as if you owned it, covering damage, theft, and liability. Rental car reimbursement covers the cost of renting the vehicle itself, but not the insurance. They may bill directly with some rental companies, like Enterprise. The cost of rental car coverage varies depending on the level of coverage you need.

While GEICO does cover rental cars, you can’t get rental-specific coverage from the company. However, you can buy coverage like a loss/collision damage waiver or personal accident coverage from the rental car agency.

The cost of coverage for rental cars depends on the type and amount of coverage you select. For example, GEICO’s liability coverage for rental cars starts at $9 per day, while collision and comprehensive coverage starts at $12 per day.

Nonowner car insurance

GEICO offers non-owner car insurance in every state in America. You do not need to be a current GEICO customer to qualify for GEICO’s non-owner car insurance. You can get a non-owner policy from them if you need to file an SR-22 or FR-44 certificate to reinstate your license. A non-owner policy can help you avoid a lapse in coverage if you are in between cars, but it’s not a good idea for the long term.

GEICO non-owner car insurance is a good investment for drivers who frequently borrow or rent cars or those who need to file an SR-22 or FR-44 with their state to prove they have insurance.

Parked car insurance

According to GEICO’s website, parked car insurance is not a specific type of coverage. However, if you’re looking for coverage for a car that is not being driven, you may want to consider storage coverage. This is an interim solution for a car that won’t be in use for an extended period of time. Storage coverage is oftentimes a much better solution than canceling your coverage altogether.

If you’re looking for comprehensive coverage for your parked car, they offer comprehensive coverage as an optional coverage you can carry to help protect your vehicle. Unlike some coverages, you don’t select a limit for comprehensive. The most it will pay is based on the actual cash value of your vehicle. You will be responsible for paying your selected deductible.

GEICO Car Insurance Claims and report accident phone number

To file a GEICO insurance accident claim, you can call 1-800-861-8380, visit GEICO’s claim reporting site, or use the mobile app. If you are not at fault, the other driver should file a claim with them, but you can also file a claim if they don’t. They will evaluate your claim based on many factors, such as your driving record, number of claims, payout amount, and accident forgiveness. You can choose any repair shop for your car or use GEICO’s Auto Repair Xpress program for fast and guaranteed repairs. If you have rental reimbursement coverage, they will help you with a rental car while your car is being fixed.

You can also report or check an insurance claim online by visiting GEICO’s Claims Center. If eligible, you can schedule a rental and repair immediately.

If you have any questions or concerns about your claim, you can contact customer service through chat or email using the Mobile app.

Comparison vs Progressive

Progressive and GEICO are two of the largest car insurance companies in the United States. GEICO offers cheaper average rates than Progressive for most drivers, except for those who have below-average credit. Also, GEICO has slightly higher customer satisfaction and fewer complaints than Progressive. Progressive has more add-on coverages and extra features than GEICO. GEICO does business mainly online or by phone, while Progressive works with thousands of agents.

GEICO is cheaper than Progressive when it comes to car insurance. On average, the coverage from GEICO is $588 cheaper per year than Progressive for someone with a clean record. In fact, the cost of car insurance from Progressive is $142 more expensive than the national average. Finally, they offer lower rates to young adult drivers when compared to Progressive car insurance, and lower rates than the national average. Progressive rates drop significantly for young adult drivers but remain above the national average.

GEICO company phone number

You can contact GEICO customer service by calling 1-800-207-7847 for general inquiries or 1-800-841-3000 for claims. You can also contact us through chat or email using the Mobile app. If you prefer to visit a local agent, you can find one near you by visiting GEICO’s website.