Welcome to InsuranceOnCheap! We’re passionate about helping our valued clients to find the best and most affordable insurance solutions. Whether you’re looking for auto, home, health, or life insurance, we’ve got you covered.

Our Story

At InsuranceOnCheap, we believe that everyone deserves access to quality insurance without breaking the bank. Our journey began when our founder, David Pootson, faced the daunting task of finding affordable coverage for his family. Frustrated by the lack of options and high premiums, he decided to create a platform that helps people find the Best insurance at the cheapest price.

Our Mission

Our mission is simple: to make insurance accessible and affordable for all. We work tirelessly to connect you with the best insurance companies and policies at the lowest rates. We believe that financial security should never be out of reach, and we’re committed to helping you protect what matters most. We do this by providing you with the knowledge and research you need to make informed insurance types you can feel confident in, so you can get back to doing the things you care about most.

The Insurance On Cheap editorial team is independent and objective. Our reviews and “best” rankings are created using strict, published methodologies and are driven solely by the editorial team in concert with industry professionals as needed. Content is informed by in-depth research, independent data gathering, analysis, expert insights, and real customer reviews.

Our Team

The Insurance On Cheap editorial team boasts decades of experience in the Insurance space. We’re passionate about helping you make the decisions and choose the Insurance products that are right for your life and goals. The team brings rich industry knowledge to coverage of life, car, pet, health, home, business, travel and other types of insurance.

Nassim Branson

Founder and Editor

After education, Nassim worked as an insurance and risk specialist for several years in different companies. Nassim then moved into technology and had a successful career in business information systems before being offered the opportunity to write for leading insurance companies in 2015.

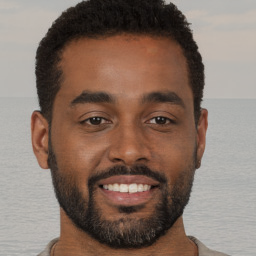

Noah Johnson

Insurance Specialist

Noah Johnson is a Insurance Specialist with over 10 years of experience in the insurance industry. He specializes in home insurance and auto insurance and is dedicated to helping clients find the right insurance solutions to protect their loved ones. With a passion for financial security and personalized service, Noah Johnson is committed to making a positive impact on the lives of those he serves.

Emma Godwin

Insurance Training Material Developer

Emma Godwin is an Insurance Analyst known for her sharp analytical mind, empathetic communication style, and forward-thinking approach to risk modeling. With over a decade of experience in the insurance and financial services sector, Emma has built a reputation for translating complex data into actionable insights that drive smarter underwriting and client-centric policy design.

Charles Robbins

Research Analyst

Charles Robbins is a seasoned Life Insurance Specialist dedicated to securing the financial future of individuals and families. With 7 years of experience, He provides expert guidance in selecting and structuring comprehensive life insurance policies, including Term, Whole, and Universal Life options. Charles Robbins’s approach is centered on detailed needs analysis and delivering personalized, sustainable solutions that offer peace of mind. He is committed to clarity, integrity, and ensuring clients fully understand the value and mechanics of their coverage.

Carlos Godwin

UX Designer

Carlos Godwin is a strategic UX Designer focused on transforming complex problems into intuitive, high-impact digital experiences. With a foundation in user research, design systems, he specializes in bridging business objectives with genuine user needs to drive measurable results. Carlos Godwin excels at the entire design lifecycle, ensuring every touchpoint is engaging, accessible, and aligned with the product vision.